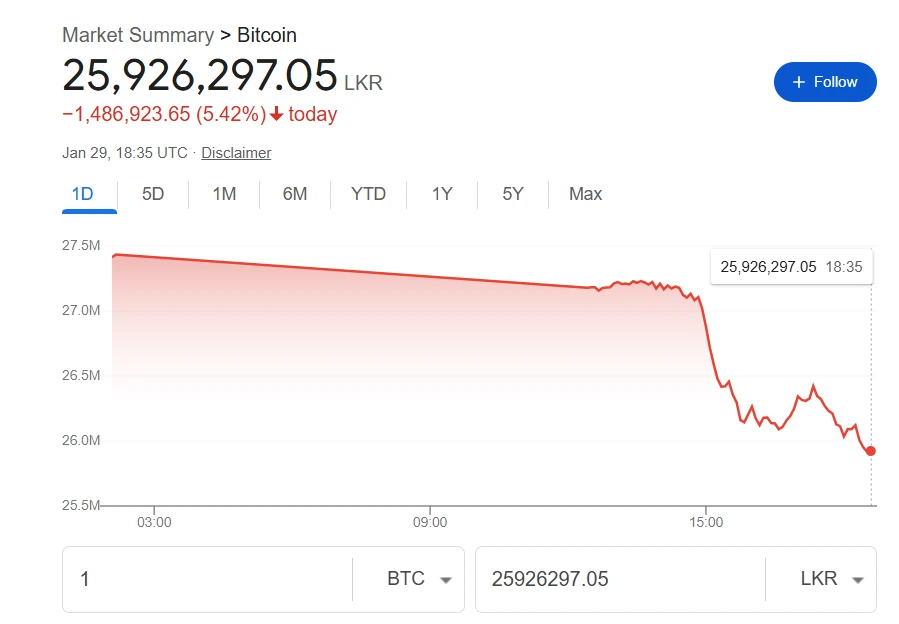

On January 30, 2026, Bitcoin (BTC) experienced another sharp decline, falling below the $84,000 level for the first time in recent trading. The cryptocurrency dropped to approximately $84,258, marking a decline of $4,910 or 5.51% in a short period, according to data highlighted by The Kobeissi Letter.

The move was accompanied by a massive wave of forced liquidations, with over $500 million in leveraged long positions wiped out within just four hours.

What Triggered the Decline?

The primary driver was a cascade of liquidations in the derivatives market:

- Traders holding leveraged “long” positions bets that Bitcoin’s price would rise were caught off-guard as the price began to fall.

- When positions move against leveraged traders, exchanges automatically close them to limit losses, triggering sell orders.

- This created a self-reinforcing downward spiral: initial selling pressure forced more liquidations, which intensified the selling and accelerated the price drop.

- The rapid nature of the move is evident in candlestick charts, showing a near-vertical decline during the most intense phase.

While no single headline appears to have sparked the initial sell-off, the event fits into a broader pattern of heightened volatility in early 2026. Ongoing macroeconomic uncertainty, including trade tensions and shifting risk sentiment, has kept cryptocurrency markets on edge. High leverage across trading platforms has amplified these moves, turning modest corrections into sharp crashes.

Market Context and Historical Patterns

Bitcoin has seen similar liquidation-driven drops multiple times, particularly during periods of elevated open interest and optimism. The cryptocurrency’s 24/7 trading nature and widespread use of leverage on perpetual futures contracts make it especially prone to these rapid swings.

Despite the severity of the drop, Bitcoin remains significantly higher than its levels from prior cycles on a longer timeframe, supported by continued institutional adoption and infrastructure development. However, short-term corrections of this magnitude serve as reminders of the asset class’s risk profile.

Implications for the Market

- Traders: Over-leveraged positions were the main casualties. Many in the crypto community view such events as “healthy” resets that clear excessive speculation.

- Investors: Long-term holders often treat these dips as noise within a broader uptrend, though they highlight the importance of risk management.

- Broader sentiment: The liquidation cascade has shifted near-term momentum bearish, with analysts watching key support levels around $80,000–$82,000 for potential further downside or stabilization.

The market showed signs of stabilizing in the immediate aftermath, but volatility is likely to remain elevated until leverage is reduced and clearer catalysts emerge.

In summary, this latest plunge underscores the interplay between leverage, sentiment, and price action in cryptocurrency markets a dynamic that has defined Bitcoin for years.

Read the previous Tech Contents in this blog: Tech Updates