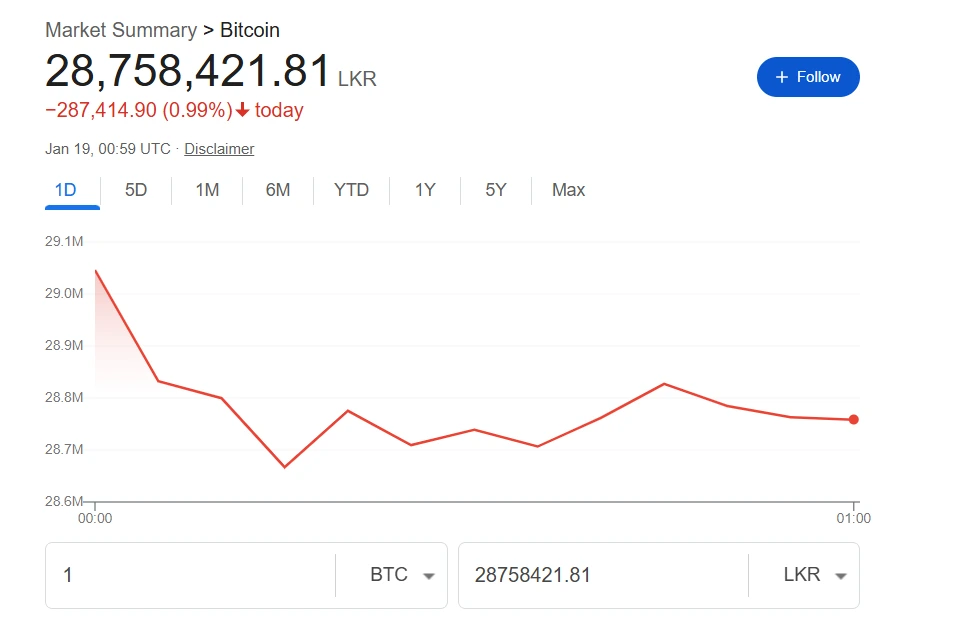

On January 19, 2026, Bitcoin (BTC) experienced a sudden and significant price decline, dropping from approximately $95,500 to around $92,000 in a matter of minutes. This represented a rapid loss of over 3%, or more than $3,000 per coin, in what market participants commonly describe as a “flash crash.”

The price correction occurred amid high market leverage, with Bitcoin briefly stabilizing near $92,000 before partial recovery. Data from major exchanges and analytics platforms indicate that the downturn was exacerbated by cascading liquidations.

Primary Cause: Forced Liquidations

The sharp decline was primarily driven by the forced liquidation of highly leveraged long positions:

- Many traders use leverage (borrowed funds) to amplify potential gains when betting on price increases (known as “long” positions).

- As the price began to fall, automated risk controls on trading platforms triggered mass sell orders to cover these positions and prevent further losses.

- Within approximately 60 minutes, over $500 million in leveraged long positions were liquidated across the crypto market.

- This wave of automated selling created a feedback loop, accelerating the downward pressure on the price.

Potential catalysts included renewed concerns over international trade tensions, particularly reports of escalating tariffs and trade disputes between the United States and the European Union. Such macroeconomic news often prompts risk-off sentiment, leading investors to reduce exposure to volatile assets like cryptocurrencies.

Context in the Broader Crypto Market

Volatility of this magnitude is characteristic of Bitcoin and the broader cryptocurrency market:

- Crypto markets operate 24/7 without pauses, unlike traditional stock exchanges, making them susceptible to rapid shifts at any time.

- Leverage trading is widespread on derivatives platforms, amplifying both upward and downward movements.

- Similar flash crashes have occurred historically during periods of high optimism and over-leveraged positioning.

Despite the short-term drop, Bitcoin remains substantially higher than its levels from previous years, reflecting ongoing institutional interest and broader adoption trends.

Implications for Investors and the Market

- For holders: Sharp corrections are common in Bitcoin’s history, and many long-term investors view them as temporary. However, they underscore the asset’s high-risk profile.

- For potential buyers: Events like this highlight the importance of risk management. Investors are advised to only allocate funds they can afford to lose and to conduct thorough research.

- Market sentiment: Following the liquidation cascade, trading activity stabilized somewhat, with observers monitoring for signs of recovery or further downside.

In summary, the January 19 flash crash was a classic example of leverage-driven volatility in cryptocurrency markets, triggered by a combination of technical liquidations and external macroeconomic pressures. While disruptive in the short term, such events are part of Bitcoin’s established market dynamics.

Read the previous Tech Contents in this blog: Tech Updates